You don’t need to have a perfect marriage to be wealthy. In fact, building a financially secure future while indulging in the pleasures of life is simple. The key is to systemize your spending.

Can you imagine waking up every day knowing that you’re saving, investing, and eliminating debt without doing a thing?

That’s what I’m going to show you. But before we create a system to automatically save you thousands, you need to have a heart-to-heart with your spouse.

As we’ve read so far in Managing Money in Marriage, arguments about money are typically not about money. They are about finding the balance between the freedom money provides and the security it represents. If you feel like the balance between security and pleasure in your relationship is at war, click here.

You’ve probably heard that the secret to financial wealth is to cut down on lattes, avoid expensive vacations, and ignore the lavish things you truly desire. And then, like magical fairy dust, you may have enough saved after 30 years to enjoy that dream of yours.

But if you’re like me, you probably want to enjoy the pleasures of life now while also enjoying financial security.

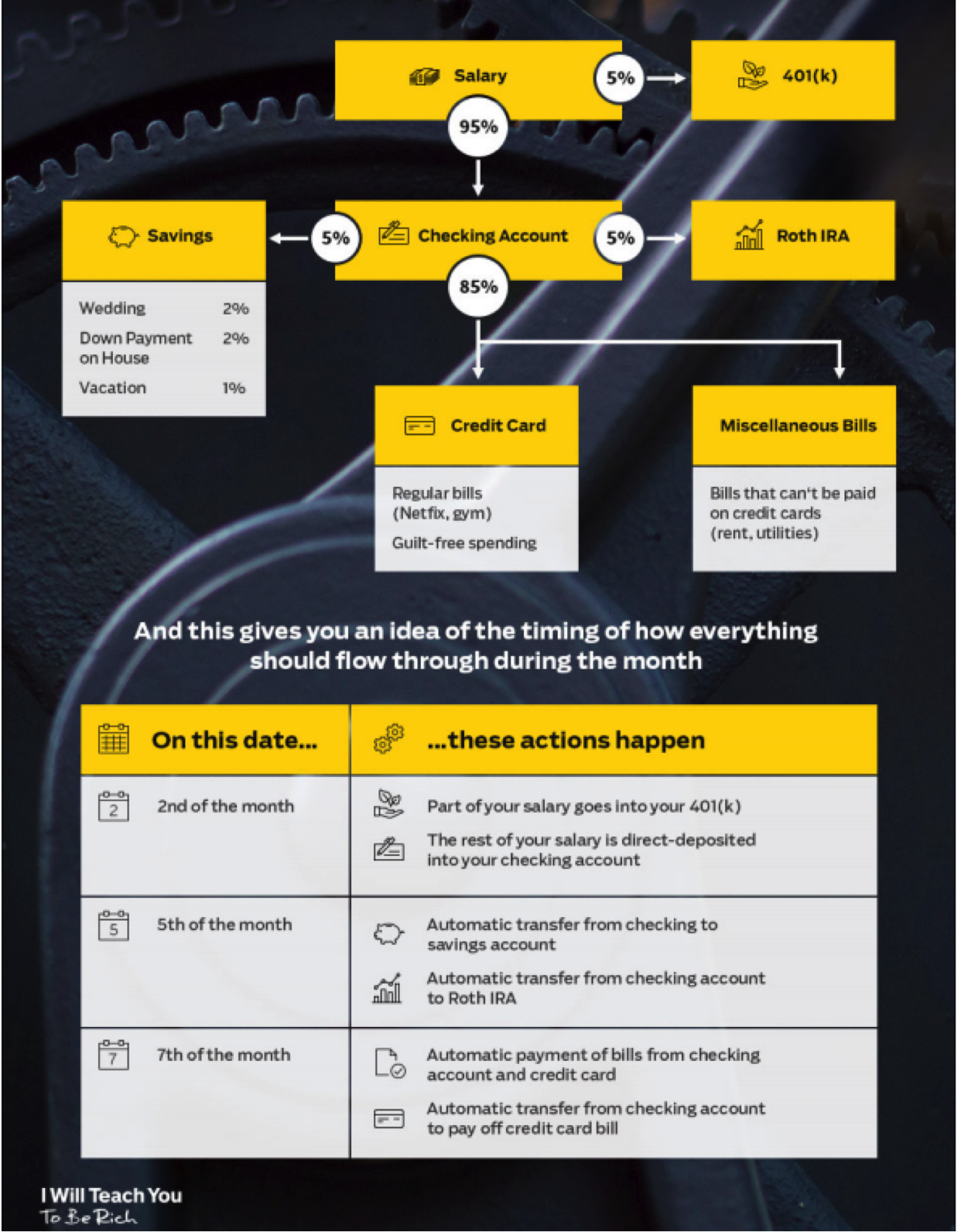

If you follow the method below (adapted from New York Times-bestselling author Ramit Sethi’s The Ultimate Guide to Personal Finance), you’ll be ahead of 99% of married couples in making this happen.

Making Investing, Saving, and Spending Painlessly Automatic

Couples struggle to save because they have to actually put their money into a savings account each month.

Making this decision every paycheck is exhausting. It’s setting your financial future up for failure.

By automating your finances, you and your spouse can set up a bulletproof money system that gets you ahead of the game.

Imagine not having to spend time paying bills, making payments, and transferring money into savings. What would you do with all the free time? Focus on the things that truly matter, like your marriage or your children?

Mindful Marriage Spending

Instead of taking on the “don’t spend money on anything expensive” motto, there’s a different mindset that can truly change how you view your expenses.

Ramit Sethi advises to “spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

Most couples spend their money without first prioritizing what is important to them. It’s the same thing couples do in their relationship. When they don’t prioritize, the dishes and chores take precedence over relationship time, leaving each partner the leftovers of each other’s attention.

Let’s look at a couple I worked with to see what mindful spending looks like in marriage.

Over the last year, John and Sherri spent $18,000 on three parties that they hosted at their house.

You might be thinking, “That’s absurd! What’s wrong with these people?”

But is there really something wrong with how this couple spends their money? Let’s find out.

John and Sherri each make a stable, six-figure salary and have invested over the years in their 401K and Roth IRA. They both have jobs that depend on their relationships with their clients, so how they spend their money actually makes a lot of sense.

Those parties lead to more relationships, and potentially more clients.

Despite their extravagant dinners, this couple has saved more than most couples I’ve spoken to.

And while $18,000 per year sounds absurd, you have to consider the context.

Look at their spending by percentage: if we assume that they make $200,000 per year in net income, their party hosting budget is less than 10% of their income.

This couple has a plan. They’re intentionally spending their money.

Most couples are unintentional when making financial decisions. They go through life without a plan, and then react when the bill arrives at the end of each month. What happens when unexpected expenses come up?

Making Your Own Mindful Money Marriage Plan

It can feel pretty difficult, but working through your finances together and creating your own mindful money plan can really set your marriage up for financial success.

Step 1: Itemize your current expenditures

Analyze what you’ve spent over the last month, six months, and year. I use the Trends tab in Mint.com to do this for me. You can also consider other budgeting software or pull out the pile of your bank statements and do it yourself.

Step 2: Make a plan on how to spend your money

Write down every expense from Step 1 that you feel is essential to both of your happiness. If either of you are at opposition, click here. You need to intentionally choose what categories you’re going to spend, save, or invest your money in.

Step 3: Optimize spending to categories

Ramit Sethi recommends that your income should be split into the following categories:

- 50-60% to pay fixed costs like rent, utilities, and long-term debt

- 10% for investments such as your 401K and Roth IRA

- 5 -10% into savings – this is money used for gifts, down payments, and unplanned expenses

- 20-35% on guilt-free spending

How to calculate your guilt-free spending: Review last month’s expenses by looking at credit card or bank statements, or use software like Mint.com. Now subtract your fixed costs, investments, and savings to come up with your guilt-free, do-whatever-you-please money.

Once you figure out the amounts for each category, create recurring transfers into your separate bank accounts. Consider separate savings accounts for a down payment on a house, an emergency fund, and a travel fund. You can also create automatic payments for your credit card balances, and recurring investments into your Roth IRA. Reviewing your finances will take less than an hour per month using this system and you’ll start saving thousands over the next year.

How to Plan for the Unplanned

I often hear couples say things like, “I got a speeding ticket,” or, “Every time we think we’re about to get ahead, something happens to the house and we have to replace appliances.”

The irony is that our “unplanned” expenses are fairly predictable over the long term. When I reviewed my expenses over a three-year period, it was clear that I spent $600 per year on maintenance and repairs for my car. That’s $50 per month. Since I know that now, it’s easy for me to set up an automatic deposit into a sub-savings account.

Based on my personal unplanned expenses, I deposit $75 a month into my emergency fund for these unplanned expenses. If it comes to the end of the year and there is money left, I follow Ramit Sethi’s advice and take out 20% to reward myself, and put the remaining back into my savings account that I split between my travel fund and down payment on a house.

So now that you have your system, are you going to use it?

There are a lot of couples who understand the ins and outs of money, yet still struggle to get out of debt. Why is that?

Information is only as helpful as how it’s used. Reading Dr. John Gottman’s popular book The Seven Principles for Making Marriage Work won’t make your marriage work unless you actually apply the principles. 20% of winning the money game in your marriage over the long-term comes from knowing what to do. The other 80% comes down to your behavior – spending, saving, and investing.

Have a conversation with your partner this week about your money plan. As you do this, remember to work together as a team. Schedule a time once a month to review your goals, dreams, and financial fears so you can make adjustments as things change over time.

If you haven’t done so already, I encourage you talk with someone (like a professional financial advisor) who can help you understand the math and meaning of money, especially if you’re just getting started.