Managing money in marriage can create tension between partners, bankrupting the relationship both financially and emotionally. This is because arguments about money are not about money. Money has a deeper meaning than the dollar value it elicits – it represents security, freedom, and the opportunity to achieve our dreams. If you feel like you and your partner are gridlocked over money issues, focus on making the conflict constructive so it can be used to build your Emotional Bank Account.

Today we are going to move beyond the meaning of money and share six steps to achieve financial security and freedom in your marriage.

Step 1: Avoid common money mistakes

Have you ever wondered why so many people divorce?

I’ve found couples don’t just fall out of love all at once. It happens slowly over time. They mindlessly ignore each other’s bids, forget to update their Love Maps, and don’t behave in ways that honor and respect each other.

This is how money works too. Very rarely do we find ourselves in debt from a single expense. It is the compounding effect of our spending over time that leads to financial trouble.

When couples do try to repair their love, they tend to focus on the wrong things. They read articles in Cosmo instead of peer-reviewed research. They buy gifts instead of being present with each other. They take extravagant trips instead of learning to love each other in the daily grind.

Money is no different. One partner tells the other to take a shorter shower, or to stop buying a latte every day so they can save a few bucks here and there. Couples make money mistakes for the same reason that chores and errands take priority when you don’t make time for your relationship. You’re stressed, you didn’t get enough sleep, and there’s a Starbucks across the street. The next thing you know, there’s a latte in your hand and you just spent $5.60 of that money you were supposed to be saving.

Another common money mistake couples make is waiting to take action. Dr. Gottman found that couples wait an average of six years to seek help for their marital problems, which I can confirm from my own experience. Not only do couples wait to make a plan for their spending, they also delay on investing into retirement and savings. Both of these put strain on the marriage, and can become a major issue if it continues to be avoided.

When it comes to money, most couples only need to focus on two things: setting up a reliable system and investing early.

Step 2: Automate money in your marriage

The best way to ignore these common mistakes is to create a system that allows you to spend your money and time on the things that truly matter. I wrote about this last week.

Ramit Sethi, a New York Times bestselling author, suggests that couples should “spend extravagantly on the things [they] love, and cut cost mercilessly on the things [they] don’t.”

I notice a pattern when couples come to me in pain. They don’t have date nights, they don’t make time for intimacy, and they don’t give each other space to discuss conflict. They expect the love to just happen like it happened in the beginning of their relationship. But it doesn’t.

By implementing a system that puts the relationship first, intimacy and connection will continue to deepen over time. This doesn’t happen by chance. Plan a weekly or bi-weekly date night. Schedule intimacy time. Give your relationship 45 minutes each week to discuss the conflicts and joys of the relationship. Dr. Gottman calls this the “State of the Union” meeting.

If you also implement a system that puts money into retirement, pays your bills, and automatically saves for the things that matter most to you, you will find yourself to be financially secure in no time. You’ll be living life with the things that matter most to you.

Step 3: Uncover hidden income

All of us have recurring expenses and bills that have the potential of being decreased. All it takes to lower your credit card and bank fees, insurance plan, and cell phone bill is to do some simple research and get on the phone for five to ten minutes.

By doing some research, I was able to refund bank fees, lower my car payment, and decrease the amount of money I had to pay to be insured.

Step 4: Continually invest in your future

Investing feels like a foreign language to most of us. But you don’t have to be Warren Buffet to make good investment decisions. The three most important things are:

- Do your own research or talk with a qualified financial advisor to help you come up with a risk allocation for your investments

- Consistently put money away

- Start early

The number one money regret of people close to retirement is not investing early enough.

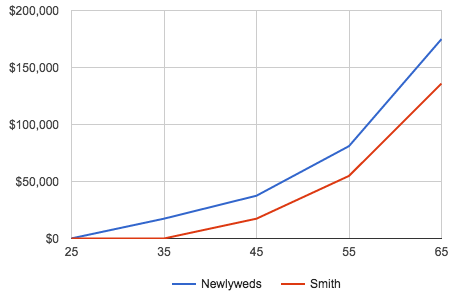

Scenario A: 25-year-old newlyweds invest $100 per month until they’re 35. Total investment over 10 years is $12,000. With an annualized return of 8% and no further investments after the age of 35, the couple will have $175,000 in their investment account at age 65.

Scenario B: The Smiths start investing $100 per month at 35 and continue until they’re 65. Total investment over 30 years is $36,000. With an annualized return of 8% over 30 years, the couple will have $136,000 in their investment account at age 65.

When they’re ready to retire at age 65, the newlyweds will have approximately $40,000 more saved than the Smiths even though they invested for 20 fewer years! Compounding interest makes starting early vital to financial freedom.

*Interest is calculated at an 8% annualized return

Becoming wealthy is not difficult. But it takes work and consistent investment.

Step 5: Painlessly get out of debt

Let’s face it. Debt is not fun. It blocks us from enjoying life and investing in ourselves. Most of us are scared to admit it because of the guilt we feel about how much debt we have.

If you avoid conflict in your marriage, you will put your relationship in emotional debt. If you avoid how much financial debt you have and how you spend your money, you will feel even worse. So take responsibility by following these fives steps created by Ramit Sethi:

- Get a big picture. Organize all of your debt in one place. I use Mint.com and find it super simple to see the big picture of where my money is.

- Choose what to pay off.

- Negotiate a lower rate with the bank or credit card company.

- Figure out how you’re going to pay for it. Decide how much of your income will be used to pay off your debt.

- Be consistent. I have automatic payments that pay for my auto-loan and student loans. I also pay more than the required amount each month to reduce the interest I have to pay over time.

Step 6: Make more money

The steps above teach you how to let your money work for you. Earning more money is the quickest way to increase your wealth.

Ultimately, there are three ways to accomplish this:

- Get a raise at your job

- Earn money on the side with skills you already have

- Start your own business

Want to create a wealthy and meaningful marriage? Then sign up for our mailing list by adding your email below and we’ll send you “The Meaning of Money in Marriage,” a bonus exercise for couples to stop fighting and start understanding each other.